Resolving Voucher / PO / Receipt Price Mismatch

Sometimes there is a situation in which a CETEC user does not know the final price of a purchase order. For example:

-

Perhaps it is not yet known what freight charge will be added to the purchase order until long after inventory has been received and the PO closed out (and potentially even that inventory having been consumed in manufacturing).

-

Or, perhaps the vendor changed pricing and is invoicing for more than the PO was originally for. CETEC users need to know how to go back and reconcile these types of price information delays or pricing discrepancies.

For context, companies will often setup a workflow-based approvals process on vendor invoice processing (called “vouchering” in Cetec ERP) so that, if the system detects anything less than a “three-way match” between the PO Line, Receipt, and Invoice (Voucher), the AP entry person must submit the voucher for approval by a manager to handle the price discrepancy.

There are three different methods you may use to process and adjust based on the price discrepancy we will explore here. (Option 3 below is useful especially in cases when the inventory received at the incorrect value has already been consumed)

Option 1

- You could cancel the receipt, edit and fix the PO line to be the correct cost, and receive it again. At vouchering, when you tie the PO Line to the voucher, it should match.

OR

Option 2

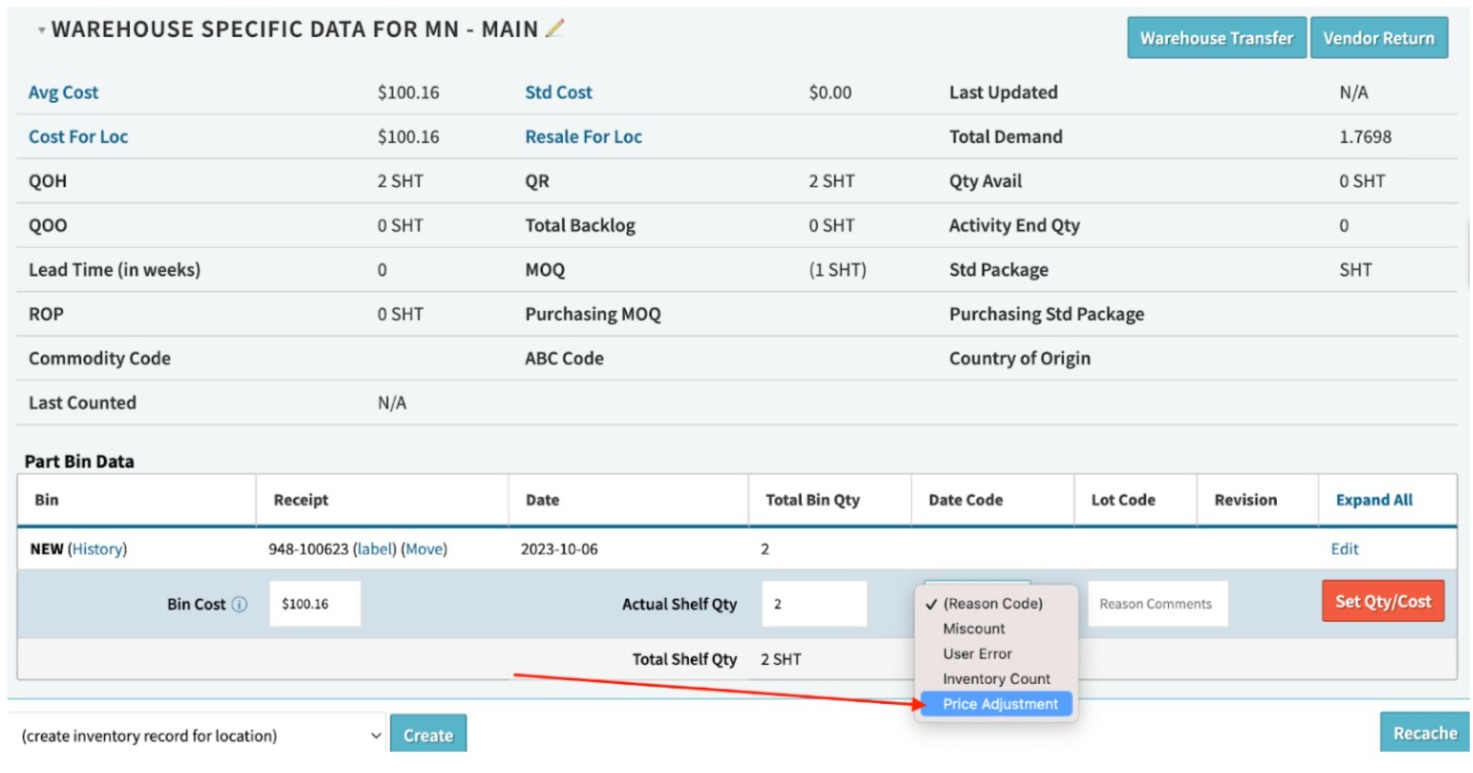

- You could make an inventory adjustment to the inventory lot/receipt to adjust its value to be the correct value.

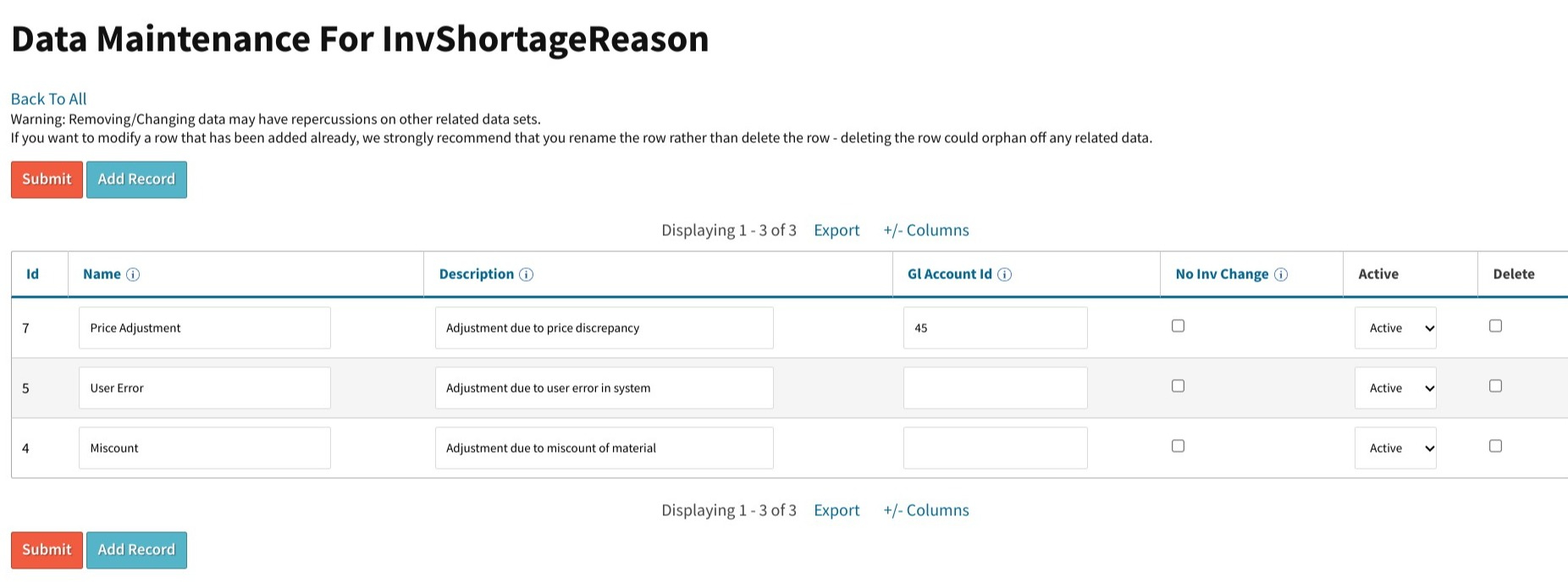

- Note, make sure you map the inventory adjustment to an inventory adjustment reason code that will post to an “Accrued Liabilities” or “Accrued Purchases” account, seen here in mapping for Data Maintenance For InvShortageReason:

That GL account ID “45” corresponds to account # 111000:

To prove this adequately addresses the price discrepancy, follow along with the following transactions and their respective Debits/Credits:

Option 2 Scenario Playout For a $3.00 PO Line Example:

- PO line is incorrectly entered at $3.00

- PO is then received at the incorrect value of $3.00 (the GL impact of this receipt is $3.00 DB inventory and $3.00 CR accrued purchases).

- However, the actual value the vendor invoices you for is $4.00, and you aren’t going to fight the vendor on it. Therefore, at Voucher entry: PO line receipt is tied to voucher defaulting the Voucher split (which by default maps to Accrued Purchases) $ amount to $3.00. The user must increase the voucher Split value from $3 to $4 so that the voucher’s splits total matches what the vendor is billing us for when we proceed to payment.

-

Thus, upon approving and submitting the voucher, the entry’s GL impact is $4.00 DB to accrued purchases and $4.00 CR Accounts Payable

-

at this point in the scenario, this leaves an orphaned $1.00 Debit amount forever in Accrued Purchases which is bad!

-

Therefore… the inventory adjustment to increase inventory price by $1.00 (to raise inventory value from $3 to $4), if it is coded to post to an Accrued Purchases account, then the GL entry resulting from the inventory adjustment will: DB inventory $1.00 (increase inventory value) and CR accrued purchases $1.00.

-

this clears that $1.00 remainder in Accrued Purchases – this is good!

- Now, your inventory is valued correctly, your vendor invoice matches and can proceed for payment, and you have no orphaned remainder in the Accrued Purchases account.

Option 3

- This option is useful especially if your inventory has already been consumed. With this option, you can leave the inventory value alone and not perform any inventory adjustment at all.

- Instead, you can tie the PO Line to a voucher, and leave the split $ amount… but then add an additional new split to the voucher and enter the $ difference on that split, so that the total of the voucher splits matches the $ amount the vendor is invoicing you for.

- Then, on that new additional split, map the G/L account to either an Expense account or a material Cost Of Goods Sold account (your preference). This will write that delta $ amount to that expense or COGS account on your P&L immediately.

Option 3 Scenario Playout For a $3.00 PO Line Example:

- PO line is incorrectly entered at $3.00

- PO is then received at the incorrect value of $3.00 (the GL impact of this receipt is $3.00 DB inventory and $3.00 CR accrued purchases).

- However, the actual value the vendor invoices you for is $4.00, and you aren’t going to fight the vendor on it. Therefore, at Voucher entry: PO line receipt is tied to voucher defaulting the Voucher split (which by default maps to Accrued Purchases) $ amount to $3.00.

- Leave that split alone, don’t change its value or mapping, so that the accrued purchases clears the same amount as the incorrect PO receipt historical cost of $3.00

- Instead add a new split of $1.00 and map that to a COGS Materials.

- This will post a DB of $1.00 to COGS Materials… which is good!

- This is good, because… when the incorrectly priced inventory previously shipped and left the building, it only posted $3.00 DB to COGS whereas it should have posted $4.00 to COGS. So you are making up for that now.